Qualify to save ~30% by paying with HSA/FSA

How to check out at Saatva with HSA/FSA funds

Checking out with Truemed is easy!

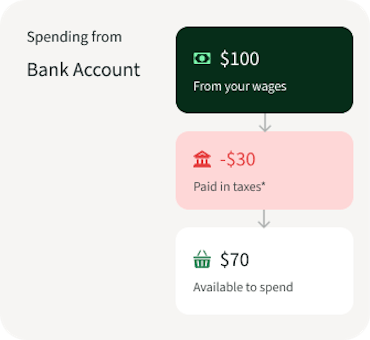

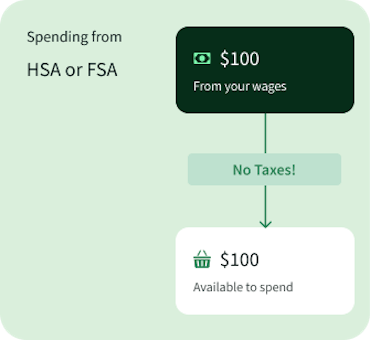

How does using my HSA/FSA save me money?

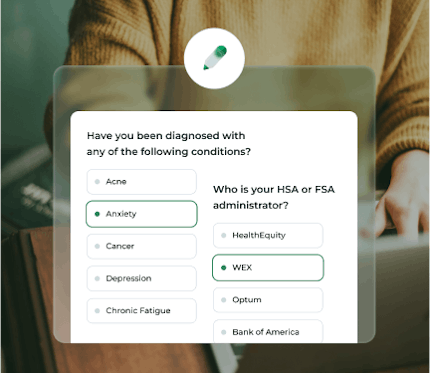

HSA/FSA accounts were created so individuals could use pre-tax money to pay for expenses used to treat, mitigate, or prevent a diagnosed medical condition.

Because HSA/FSAs use pre-tax money, you’re getting more purchasing power for your dollars. Rather than pay taxes on income and then spend it on health items, qualified customers can use pre-tax funds to invest in root cause interventions.

Who is Truemed?

At Truemed, we believe that investing in your health is far more valuable than waiting to spend on sickness. By unlocking pre-tax HSA/FSA spend on research backed interventions such as fitness, supplements, and health technology, we’re shifting healthcare spend toward true medicine.

FAQsFrequently asked questions

HSA/FSA accounts were created so individuals could use pre-tax money to pay for expenses used to treat, mitigate, or prevent diagnosed medical conditions. Because HSA/FSAs use pre-tax money, you’re getting more purchasing power for your dollars. Rather than pay taxes on income and then spend it on health items, qualified customers can use pre-tax funds to invest in their health.

An individual can contribute up to $4,150 pretax to their HSA per year, or $8,300 for a family (plus an additional $1,000 if you are at least 55 years old. Individuals can contribute up to $3,200 pretax to their FSA per year (with an additional $500 in employer contributions allowed).Health savings accounts (HSA) and flexible spending accounts (FSA) are programs that allow you to set aside pre-tax dollars for eligible healthcare expenses. If you’re unsure whether or not you have an HSA or FSA account, please check with your employer or insurance company.

Saatva does not support checking out with your HSA/FSA CARD. You can complete your purchase with any payment method that Saatva supports and then submit for reimbursement as outlined above.

You can use any payment method Saatva offers to make the initial purchase of an eligible product and still get reimbursed.

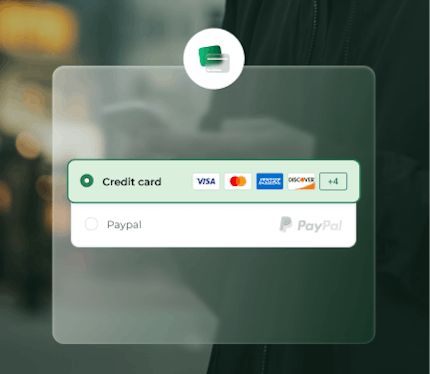

Saatva accepts the following payment methods:

- Credit cards: Visa, Mastercard, American Express, Discover

- Affirm

- PayPal

- Google Pay

- Apple Pay

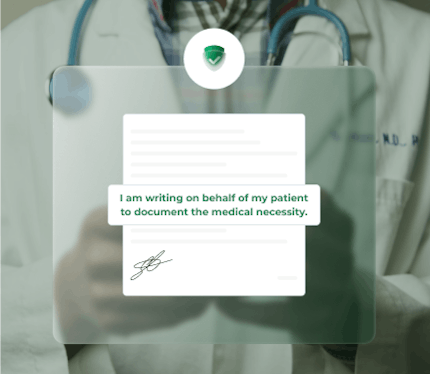

The items in your Truemed Letter of Medical Necessity (“LMN”) are now qualified medical expenses in the same way a visit to the doctor’s office or pharmaceutical product is.

There are thousands of studies showing food and exercise is often the best medicine to prevent and reverse disease. Exercise qualifies as a qualified medical expense with an LMN. Food, supplements, and other wellness purchases, such as a new mattress, qualify as medical expenses if they treat or prevent an illness, and a doctor substantiates the need. Your Truemed LMN satisfies all IRS requirements to make your wellness spend fully reimbursable.There is no cost to you, as long as you are shopping with a Truemed partner merchant.

You can use your FSA/HSA dollars all year long. However, FSA dollars expire at the end of the year and unused money may not rollover into the next year. Make sure to spend the rest of your FSA dollars before December 31st — use it, so you don’t lose it!

Generally it takes 2-5 hours. In some cases, Truemed’s provider team will require additional time to issue a letter of medical necessity based on the needs associated with an individual qualification survey. If you aren’t seeing your letter in your inbox, check spam, then reach out to us at support@truemed.com for help.

Unfortunately, Truemed’s services are for individuals who have HSA or FSA accounts (or plan to fund one during open enrollment). We encourage you to ask your employer about information on your HSA or FSA.

Unfortunately, Truemed is currently only available in the United States.