- Home

- Financing

Pay at your own pace with Affirm

When inspiration strikes, Affirm helps you say yes without giving up financial control. Select Affirm at checkout to pay over time—and never pay a penny more than you agree to on day one.

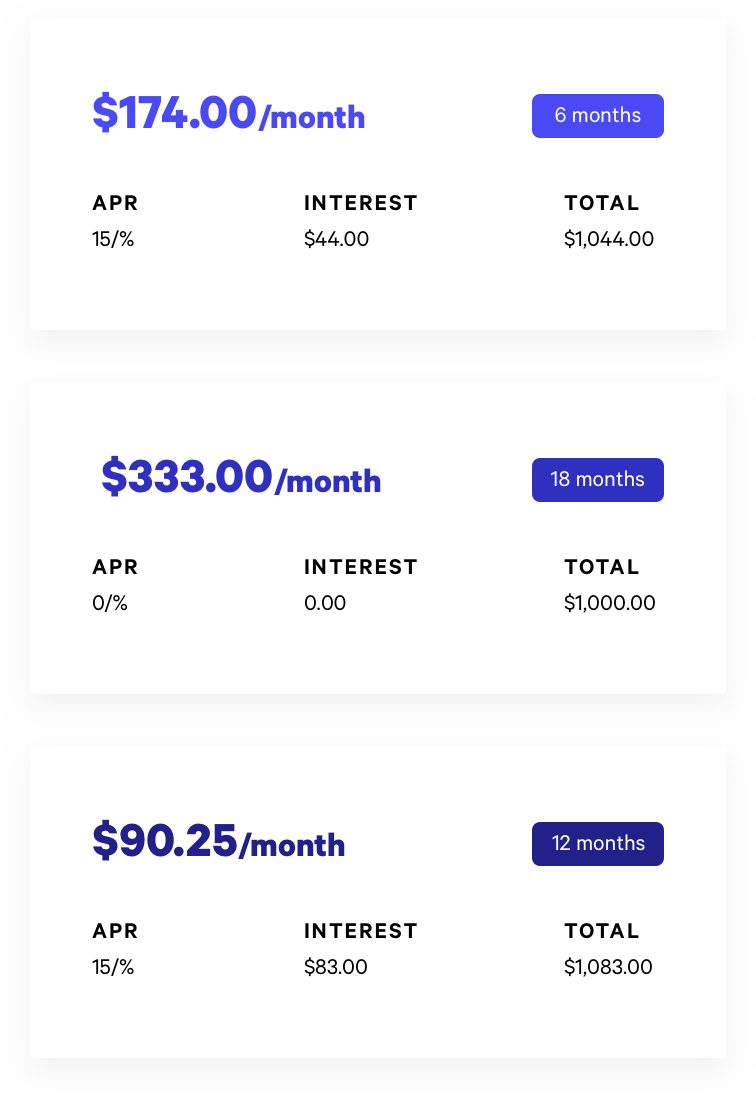

Choose 6, 12, or 18 monthly payments

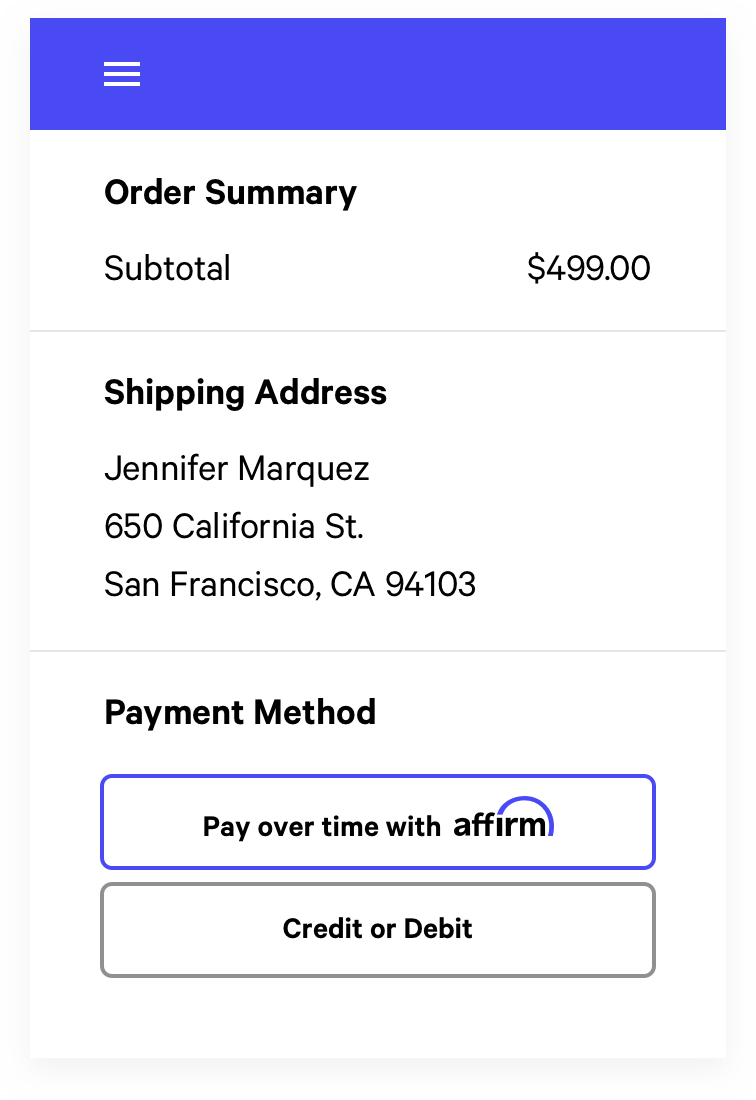

Buying with Affirm is simple

Buy with confidence

With Affirm, you always know exactly what you'll owe and when you'll be done paying.

FAQsFrequently asked questions

Affirm is a financing alternative to credit cards and other credit-payment products. Affirm offers payment options for eligible customers to pay for their purchase over time in fixed installments, with no late or hidden fees.

• Buy and receive your purchase right away, and pay for it over several months. This payment option allows you to split the price of your purchase into fixed payment amounts that fit your monthly budget.

• If Affirm approves your loan, you'll see your loan terms before you make your purchase. See exactly how much you owe each month, the number of payments you must make, and the total amount of interest you'll pay over the course of the loan. There are no hidden fees.

• The application process is secure and real-time. Affirm asks you for a few pieces of information. After you provide this information, Affirm notifies you of the loan amount that you're approved for, the interest rate, and the number of months that you have to pay off your loan -- all within seconds.

• You don't need a credit card to make a purchase. Affirm lends to the merchant directly on your behalf.

• You may be eligible for Affirm financing even if you don't have an extensive credit history. Affirm bases its loan decision not only on your credit score, but also on several other data points about you.

• Affirm reminds you by email and SMS before your upcoming payment is due. Enable Autopay to schedule automatic monthly payments on your loan.

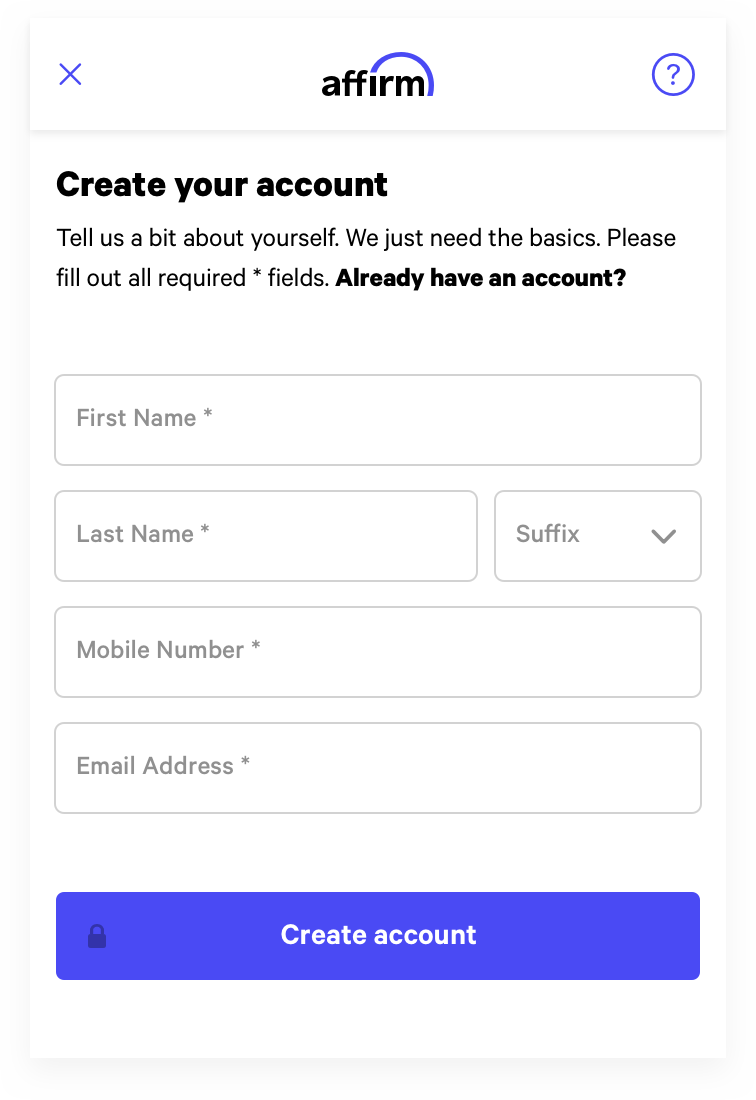

To sign up for Affirm, you must:

- Be a resident of the U.S. (including U.S. territories)

- Be at least 18 years old (19 if you’re a ward of the state of Nebraska)

- Have a Social Security number

- Own a phone number that receives SMS and is registered to the United States or U.S. territories.

•Affirm asks for a few pieces of personal information: Name, email address, mobile phone number, date of birth, and the last four digits of your social security number.

•Affirm verifies your identity with this information and makes an instant loan decision.

•Affirm bases its loan decision not only on your credit score, but also on several other data points. This means that you may be able to obtain financing from Affirm even if you don't have an extensive credit history.

Although Affirm performs a credit check when you apply for a loan, this won’t impact your credit score. However, if you’re approved and decide to buy with Affirm, your loan and payments may affect your credit score. Paying on time can help you build a positive credit history.

The merchant has no information regarding a customer's financing denial. Affirm strives to offer all credit-worthy applicants financing with Affirm, but isn't able to offer credit in every case. Affirm will send you an email with more details about its decision. Unfortunately Affirm's decision is final.

If Affirm has difficulty confirming your identity, you may need to provide more information. Affirm uses modern technology to confirm your identity, including verifying your address or full SSN, or requesting a photo of your ID. Affirm takes these steps in some cases to counter fraud and provide the most accurate credit decision they can.

Affirm may sometimes need more information about your finances and your ability to repay in order to make a credit decision. Your income gives Affirm additional insight into your ability to repay.

Affirm may sometimes need more information about your finances and your ability to repay in order to make a credit decision. If you are prompted to link your checking account and would like to proceed, please provide the login information for your online bank account. Affirm does not store your online login credentials---they are transmitted securely to your bank.

If Affirm asks you to link your checking account, Affirm won't be able to offer you credit if:

- Your bank is not listed

- You choose not to link your checking account

- You don't use online banking

- The username and / or password you provide is incorrect

- You're unable to successfully connect your checking account

Although Affirm is continually adding support for additional banks, they aren't able to connect to every bank at the present time. We apologize for the inconvenience. If you're unable to connect your bank, you'll need to complete your purchase with another payment method.

Affirm isn't always able to offer credit for the full amount you request. In these cases, Affirm asks you to make a down payment with a debit card for the remainder of your purchase. The down payment amount can't be changed and must be made upon confirming your loan and before the loan offer expires.

Yes! Affirm works hard to be completely transparent. You'll see the amount of interest you'll owe on the terms page and again on the loan confirmation page. If you pay off your loan early, you'll receive a rebate for any interest that hasn't yet accrued.

Affirm is available only to shoppers residing in the United States and Canada. Affirm hopes to expand its services to customers outside the U.S. and Canada in the future.

Before each payment is due, Affirm sends you an email or SMS reminder with the installment amount that is coming due and the due date. You have the option to sign up for autopay, so you don’t risk missing a payment.

Follow these steps to make a payment:

1. Go to www.affirm.com/account.

2. Enter your mobile phone number. Affirm sends a personalized security PIN to your phone.

3. Enter this security PIN into the form on the next page and click Sign in.

4. After you sign in, a list of your loans appears, with payments that are coming due. Click the loan payment you would like to make.

5. Make a payment using a debit card or ACH bank transfer.

Your first monthly payment to Affirm is usually due one month after we process your purchase. Each following payment will be due a month later on the same day of the month.

Yes, you have the option to pay off your balance early without fees or penalties.

Yes. Affirm uses encryption to keep your information secure and confidential.

A refund posts to your Affirm account if we process your refund request. In the event that we issue you store credit instead of a refund, you are still responsible for paying off your Affirm loan.

If you have already made loan payments or a down payment, Affirm issues a refund credit to the bank account or debit card that you used to make the payments.

NOTE: Affirm does not refund any paid interest.

A refund credit appears in your account within three to ten business days, depending on your bank's processing time.

You cannot edit your order after you have confirmed your loan. If you want to add items to your purchase, apply for another loan with Affirm or use a different payment method.

Contact one of our sleep guides at 1-877-672-2882 for help with your order or to process a return. The portion of your loan that you’ve already made payment on will be refunded by Affirm.

NOTE: Affirm does not refund any paid interest.

If you have not received your order within the original delivery or shipping timeframe estimated, contact one of our sleep guides at 1-877-672-2882.

Please note that while waiting for your order to arrive, you may still have to make your first payment to Affirm within 30 days.

You can reach Affirm at affirm.com/help or call the Affirm Customer Care team at (855) 423-3729 every day from 7am to 10pm CT.

No. After March 31, 2022, Klarna is no longer available as a payment option on Saatva. If you have a question about your active Klarna monthly financing plan, please contact Klarna at https://www.klarna.com/us/customer-service/ or by downloading the Klarna App. As always, for any Saatva warranty or product-related questions, you can reach us at 1-877-672-2882, info@saatvamattress.com, or through chat.

For questions about your Klarna monthly financing, please contact Klarna at https://www.klarna.com/us/customer-service/ or by downloading the Klarna App. As always, for any Saatva warranty or product-related questions, you can reach us at 1-877-672-2882, info@saatvamattress.com, or through chat.